Automate Billing Processes in NetSuite

NetSuite has many different options to “auto-bill”. Depending on your infrastructure, integrations, and business model, you may have evaluated some of these options and taken up the one that makes the most sense. Choosing the right option is crucial in automatically creating transactions and helping your staff save time, increase their productivity, and only review certain transactions that are flagged as problematic. If you do not know which one to choose yet, or are considering NetSuite to handle your invoicing/billing needs, this article is for you.

Note: although these approaches can be used for both B2B and B2C transactions, the descriptions and examples below relate best to B2C transactions.

Creating Cash Sales - this option is attractive to businesses that require payment on delivery of goods. At the simplest level, think of a simple sale transacted at your local grocery store. You pay for the food immediately with credit card, debit card, Cash, check, and the grocery store gives you the food. Although the process gets a bit more complicated with credit card transactions as these incur fees, the idea is the same: there is an immediate exchange of goods and the seller books the transaction immediately and receives “Cash”, hence the “Cash Sale”.

NetSuite allows for the creation of a standalone Cash Sale, as well as a Sales Order>Cash Sale combination. Your path here will depend on if there is a fulfillment process involved in the transaction. The GL impact will also differ depending on the path chosen. The standalone Cash Sale will include the Credit to the Inventory and Debit to COGS as it assumes everything happened at the same time (therefore combining the “deposit” and the Item Fulfillment.) A Sales Order>Fulfillment>Cash Sale combination will separate the Item Fulfillment GL Impact from the Cash Sale GL Impact.

Take a sale of a physical good executed through an online web front as an example. The customer must provide a valid credit/debit card to complete the purchase, and there is no expectation that the customer will receive the product at the exact same moment. The transaction must be processed through the company’s ERP and fulfilled from a warehouse. This takes time. In this example it may be advantageous to consider the creation of a Sales Order first to signal demand, and a fulfillment separate from the exchange of Cash - or Cash Sale. The flow for this process would be as follows:

Customer places Order

Customer pays for Order at the same time

A Sales Order is created in NetSuite

An attached Cash Sale is also processed and attached to the Sales Order

The Item Fulfillment is also created and attached to the Sales Order

The Order is complete and Closed.

Selecting a Payment Option of “Cash” on the Sales Order will result in a Cash Sale being created upon Billing

There are many advantages to this process flow. First, the record of Cash is immediately available. This also allows you to separate the physical supply and demand of the good from the Cash received and the general accounting treatment of the transaction. One downside that is worth mentioning is the need for a Payout Reconciliation process to occur at the end of the month. Because the Cash Sale will Debit Cash for the full order amount, it is necessary to also book the commissions and fees incurred to process the transaction (for example the fees that Shopify and the Bank bill you) to fully reconcile end of month cash balances.

You may also use “Undeposited Funds” as a buffer between the Cash processed via Credit Card and the Deposit made from the processor to your bank. This is especially useful for eCommerce companies and is a best practice to handle the timing discrepancy.

2. If you need to create a true Invoice transaction to process a Sale, there are also a few options available for you.

A) Create a workflow with a specific Saved Search criteria of Sales Orders that should be auto-invoiced.

This is a nice option as the creation of the Saved Search criteria allows you to be very specific about which orders should be invoiced. For example, only Sales Orders of Customer Type “Web”, with a Sales Order Status of “Pending Billing'' should be invoiced. Set the schedule to run on the workflow every 30mins and the workflow will take care of auto invoicing the sales orders specified in your criteria.

Workflow Scheduled initiation type, with a Saved Search as a filter

Next, create a “Transform Record” action type and direct it to create an Invoice record. The result of this is that NetSuite will process invoices for the Sales Order specified in the Saved Search criteria every 30mins.

Transform Record workflow action

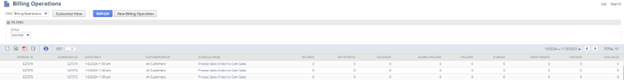

B) The second type of auto-billing is called “Billing Operations”. This is a native NetSuite feature that, if used correctly, creates Invoices almost exactly the same way that option A above can. The difference is that the User Interface for creating the billing operation is a bit more user friendly, and that the Status page that is native to the Billing Operation shows users very clearly how many invoices were processed, when, with links to the transactions created.

First, make sure that the feature is turned on under Enable Features.

Then, navigate to Transactions>Billing>Schedule Billing Operation.

To create the schedule, give it a name, a Schedule frequency, and a Saved Search as the criteria. Notice that the parameters for the operation are identical to the one in Option A.

As previously mentioned, the biggest advantage to using this automatic scheduling function is the detail available to the user on the number of transactions processed, and of what types: Cash Sales, Invoices, Credit Memos, and Charges. Head to Transactions>Billing>Process Billing Operations>Status to see the status page.

To conclude, one additional consideration is the role that integrations play in this structure. If you have an iPaaS platform that helps to facilitate the transactions processed, take some time to understand the different process flows in this article to determine the transactions flows your business needs. As a best practice, identify and document your current business processes and implement data flows that facilitate the processing of these transactions.

Want to learn more? Contact us at help@racetteconsulting.